Does this strategy only apply to assets held long term?

Can donated assets be invested while they sit inside a DAF or CRT?

Do all DAF and CRT administrators accept the same types of assets?Why Selling Before Donating Is a Costly Tax Mistake (Stock, Crypto, Real Estate Examples)

TL;DR:

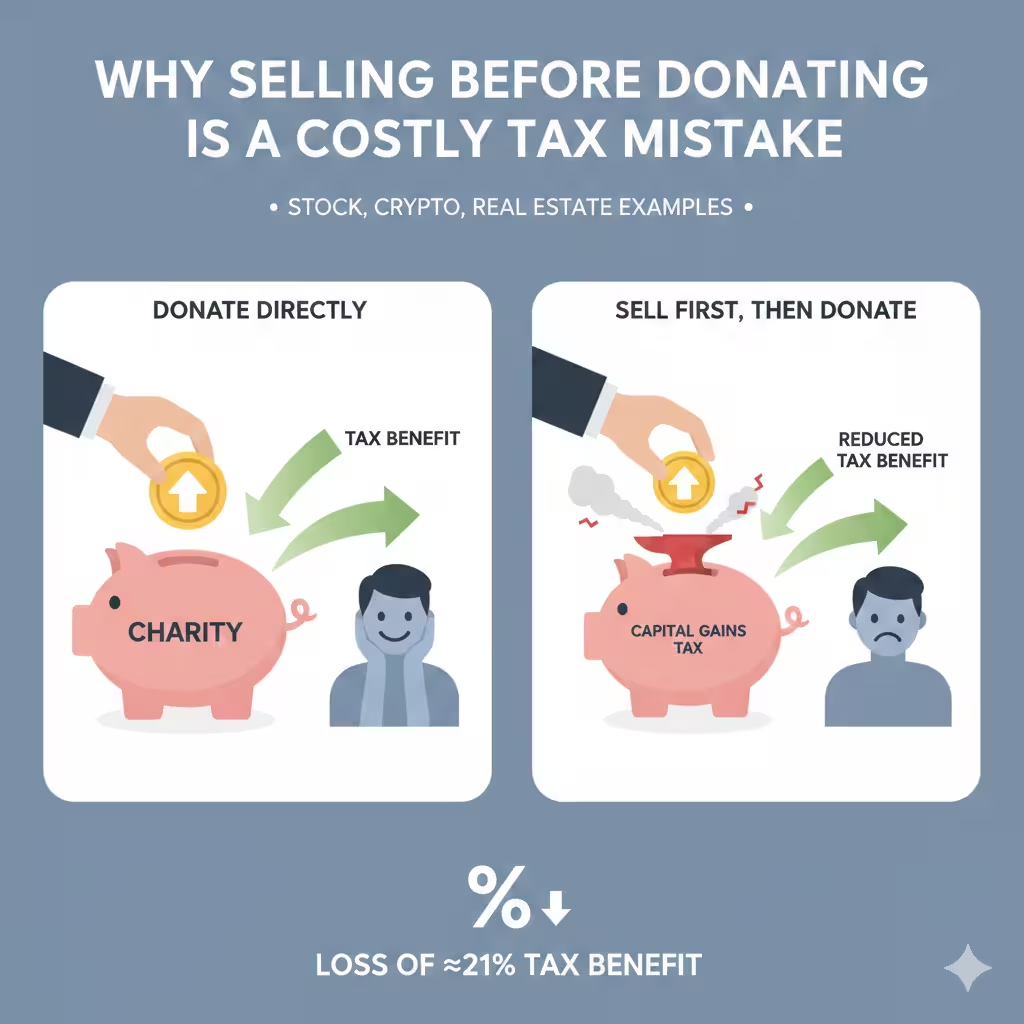

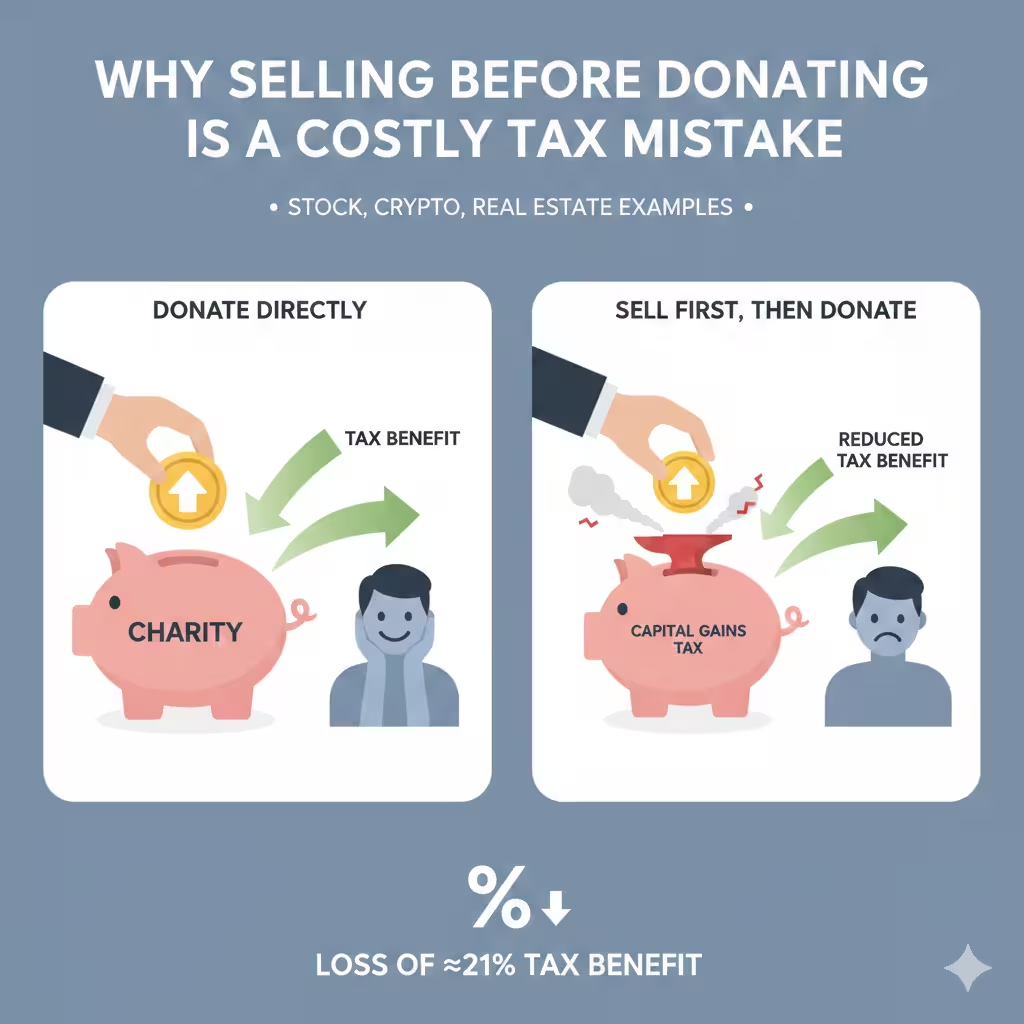

Selling appreciated assets before donating permanently reduces your tax benefit. Using a $100,000 asset with a $50,000 cost basis, donating directly can produce an effective tax benefit of roughly 59%, while selling first drops that benefit to about 38%. The difference comes entirely from triggering long-term capital gains tax before the donation.

Quick navigation

Most people understand that donating appreciated assets can reduce taxes. What far fewer people realize is how much money is lost simply by selling first, even when the donation amount feels almost the same.

The difference is not subtle. It comes down to whether capital gains tax is triggered before the donation happens.

The baseline asset

This same baseline is used in “How High W-2 Earners Can Cut Taxes 50%+ by Donating Appreciated Assets (2026 Update)”, where the full mechanics of how this asset produces a 50%+ effective tax benefit are explained step by step.

Assume you own an appreciated asset with:

• Fair market value: $100,000

• Original cost basis: $50,000

• Unrealized long-term capital gain: $50,000

You are a high-income earner subject to top federal income tax, Net Investment Income Tax, and state income tax.

For long-term capital gains, a combined rate of approximately 30% typically reflects:

• 20% federal long-term capital gains

• 3.8% Net Investment Income Tax

• 6–10% state tax

This combined rate commonly applies to high earners in states such as California, New York, New Jersey, Massachusetts, and Oregon.

Donating appreciated assets directly

You donate the $100,000 appreciated asset directly to a Donor-Advised Fund.

What happens:

• Capital gains tax triggered: $0

• Amount deducted: $100,000 (fair market value)

• Ordinary income tax avoided: approximately $59,000

Effective outcome:

• Asset value donated: $100,000

• Tax saved: about $59,000

• Effective benefit rate: roughly 59%

This result comes from combining two effects:

1) Capital gains are never realized

2) The full fair-market-value deduction offsets high marginal income

This framework is explained in detail in the article titled “How High W-2 Earners Can Cut Taxes 50%+ by Donating Appreciated Assets (2026 Update).”

Selling first, then donating

Now assume the same asset, same value, and same intent, but the asset is sold first.

Step one is the sale:

• Sale price: $100,000

• Cost basis: $50,000

• Long-term capital gain: $50,000

Capital gains tax owed:

• $50,000 × 30% = $15,000

This $15,000 is a real cash outflow. It is paid from the asset proceeds and cannot be recovered or offset later.

Cash remaining after tax:

• $100,000 − $15,000 = $85,000

Step two is the donation:

• Donation amount: $85,000

• Deduction allowed: $85,000

Ordinary income tax avoided:

• $85,000 × approximately 45% = about $38,250

The key point is that the capital gains tax is already gone. The only tax benefit created is the deduction on the smaller donation.

Side-by-side comparison

Nothing about the asset changed.

Donate Appreciated Asset Directly

Sell First, Then Donate

Asset fair market value

$100,000

$100,000

Cost basis

$50,000

$50,000

Capital gains realized

$0

$50,000

Capital gains tax paid (≈30%)

$0

$15,000

Amount available to donate

$100,000

$85,000

Charitable deduction allowed

$100,000

$85,000

Ordinary income tax avoided (≈45%)

$59,000

$38,250

Total effective tax benefit

$59,000 (≈59%)

$38,250 (≈38%)

Tax benefit lost by selling first

$20,750

Nothing about the generosity changed.

Only the order of operations changed.

Why this applies beyond stocks

Although stocks make the math easy to illustrate, the same logic applies to many asset types, often with even larger consequences.

This includes:

• Public stocks and ESPP shares

• Crypto assets

• Real estate

• Art and collectibles

• Alternative investments and private assets

Assets with large embedded gains suffer the most damage when sold first. This is why many non-cash assets are among the most powerful to donate directly, as explained further in “How Donor-Advised Funds Really Work: Stock, Crypto, Real Estate, and Alternative Assets Explained.”

When selling first may still make sense

There are limited situations where selling first can be reasonable:

• The asset has little or no appreciation

• The gain is short-term and minimal

• Liquidity timing is critical

• The asset is not eligible for direct donation

Outside of these cases, selling before donating is usually not a strategy. It is a structural tax mistake.

Closing thoughts

Most Donor-Advised Fund (DAF) and Charitable Remainder Trust (CRT) discussions stop at theory. In reality, the administrator you choose determines what assets you can donate, how funds are invested, how often distributions are required, and how much flexibility you actually have. That gap is exactly why I created “DAF & CRT Administrators Worth Your Time: A Vetted Guide for Complex Portfolios.”"

Frequently Asked Questions

Yes. The primary tax benefit of donating appreciated assets comes from avoiding long-term capital gains tax, which generally requires the asset to be held for more than one year. Assets held for one year or less are typically treated as short-term and do not receive the same tax advantage when donated.

It depends entirely on the administrator. Some sponsors allow broad investment flexibility, while others restrict assets to a limited menu or require rapid liquidation. These operational differences can materially affect outcomes, especially when timing, volatility, or liquidity matter.

No. Acceptance policies vary widely. Some administrators only support publicly traded securities, while others can handle private investments, real estate interests, or digital assets. Choosing an administrator that aligns with the assets you plan to donate is critical to executing the strategy correctly.