Three Powerful Steps for a Donor-Advised Fund: Donate High, Invest Low, Grant Later

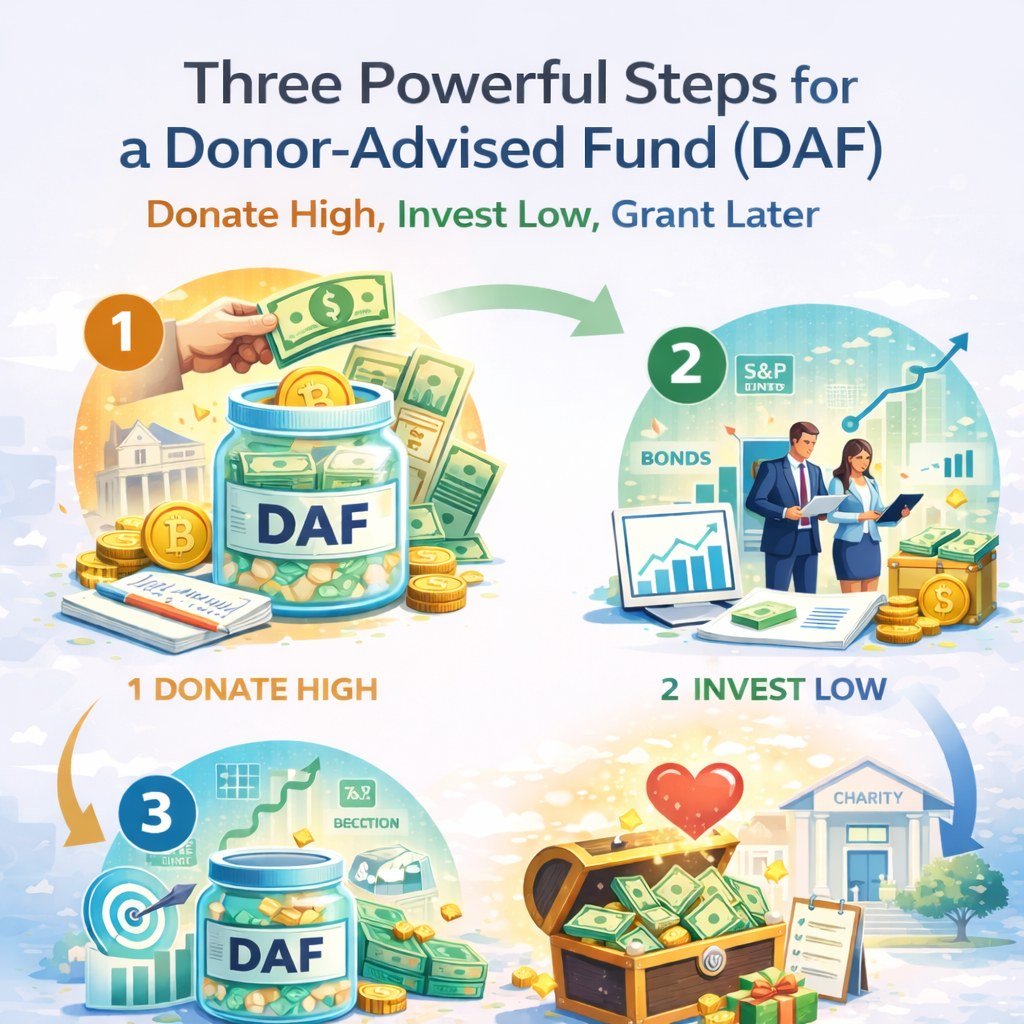

Three Powerful Steps for a Donor-Advised Fund (DAF): Donate High, Invest Low, Grant Later TL;DR: Donor-advised funds let you contribute appreciated assets in a high-income year to claim a deduction, then invest the proceeds inside the DAF and recommend grants over time. The key is separating what you donate (stock, crypto, RSUs/ESPP, real estate, alternatives) […]

DAF vs CRT Deduction Limits Under the Big Beautiful Bill (2026)

2026 DAF Deduction Limits Under Trump’s One Big Beautiful Bill: What High W-2 Earners Need to Know TL;DR: Starting in 2026, Trump’s One Big Beautiful Bill Act adds a 0.5% AGI floor for itemized charitable deductions and limits the value of itemized deductions to 35% for top-bracket taxpayers. Here’s how to plan DAF contributions, bunching, […]

How High W-2 Earners Can Cut Taxes by 50%+ by Donating Appreciated Assets (2026)

How High W-2 Earners Can Cut Taxes by 50%+ by Donating Appreciated Assets (2026 update) TL;DR (Quick Summary) High W-2 earners in high-tax states can often unlock an effective 50%+ tax benefit by donating appreciated assets (like stock or crypto) instead of selling first: you may be able to deduct the fair market value (if […]