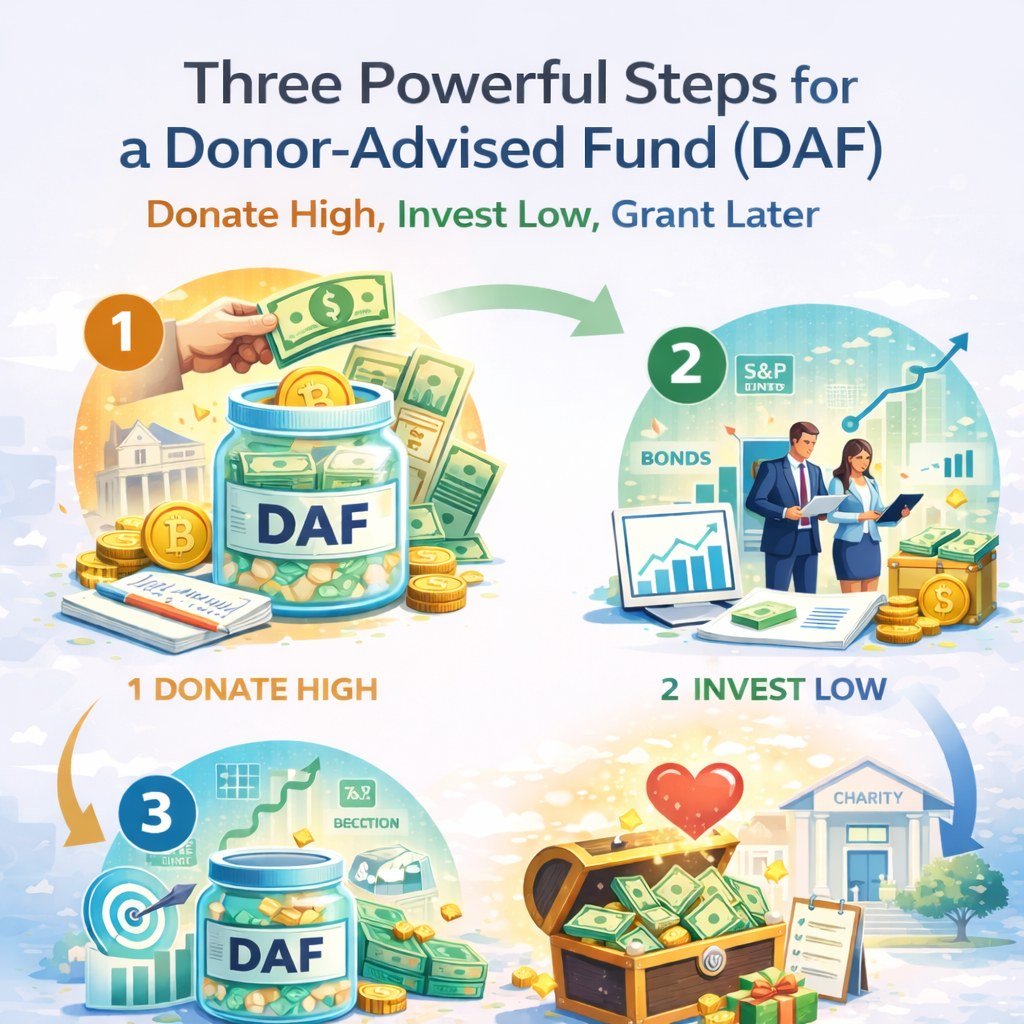

Three Powerful Steps for a Donor-Advised Fund: Donate High, Invest Low, Grant Later

Three Powerful Steps for a Donor-Advised Fund (DAF): Donate High, Invest Low, Grant Later TL;DR: Donor-advised funds let you contribute appreciated assets in a high-income year to claim a deduction, then invest the proceeds inside the DAF and recommend grants over time. The key is separating what you donate (stock, crypto, RSUs/ESPP, real estate, alternatives) […]

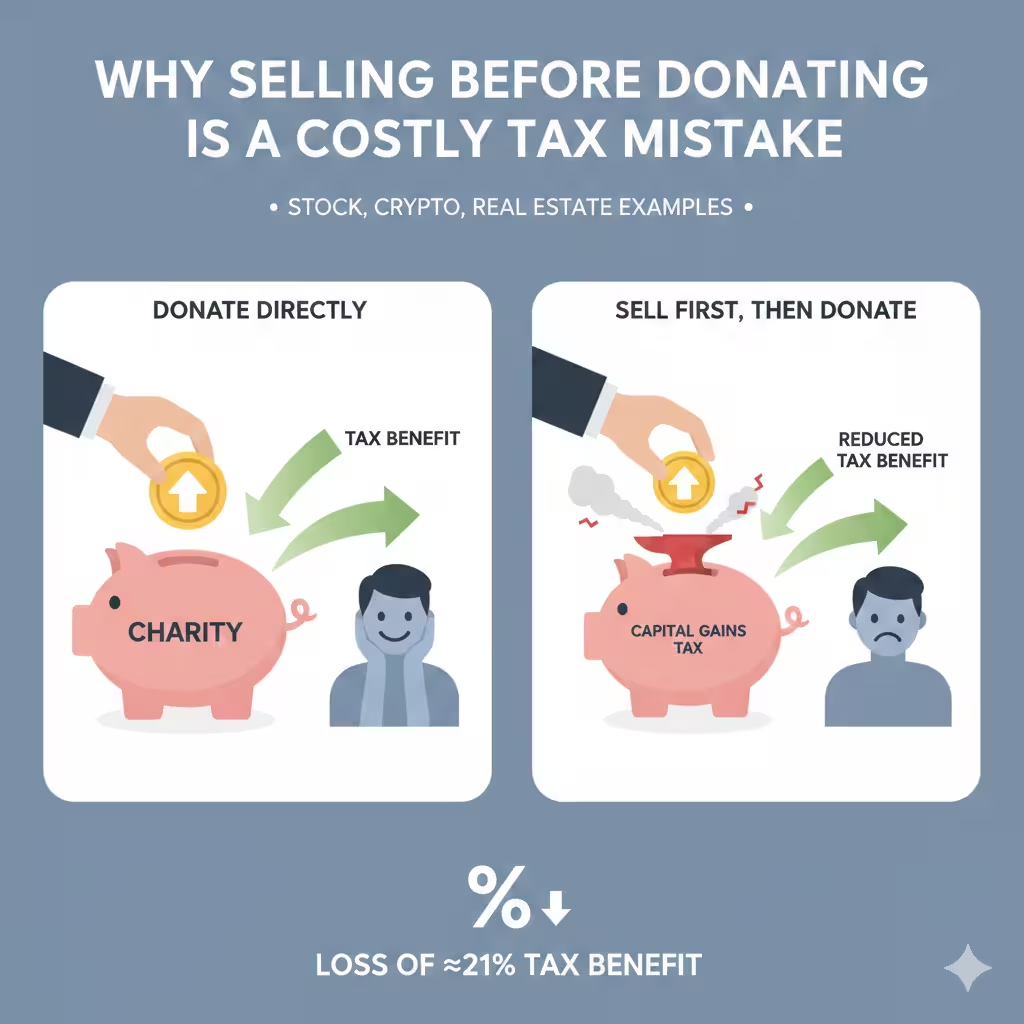

Why Selling Before Donating Is a Costly Tax Mistake (Stock & Crypto)

Why Selling Before Donating Is a Costly Tax Mistake (Stock, Crypto, Real Estate Examples) TL;DR: Selling appreciated assets before donating permanently reduces your tax benefit. Using a $100,000 asset with a $50,000 cost basis, donating directly can produce an effective tax benefit of roughly 59%, while selling first drops that benefit to about 38%. The […]