Authorized User Tradelines vs. Credit Repair: Which is Faster?

Authorized User Tradelines vs Credit Repair: When Each Works Better TL;DR: There are two main ways to improve a credit score. Credit repair focuses on fixing past problems by working with creditors and credit bureaus, which often takes months. Authorized user tradelines don’t fix old mistakes, but they add strong positive information to your credit […]

How Long Do Authorized User Tradelines Take to Report to credit bureaus

How Long Do Authorized User Tradelines Take to Report? Realistic Timelines Explained Financial disclosure: OptimizeEstate.com provides educational content and also offers authorized user tradelines for sale. This article is not legal, tax, or credit advice. Results vary by credit profile, lender, and bureau reporting. Always verify details on your own credit reports before making time-sensitive […]

Three Powerful Steps for a Donor-Advised Fund: Donate High, Invest Low, Grant Later

Three Powerful Steps for a Donor-Advised Fund (DAF): Donate High, Invest Low, Grant Later TL;DR: Donor-advised funds let you contribute appreciated assets in a high-income year to claim a deduction, then invest the proceeds inside the DAF and recommend grants over time. The key is separating what you donate (stock, crypto, RSUs/ESPP, real estate, alternatives) […]

Why Selling Before Donating Is a Costly Tax Mistake (Stock & Crypto)

Why Selling Before Donating Is a Costly Tax Mistake (Stock, Crypto, Real Estate Examples) TL;DR: Selling appreciated assets before donating permanently reduces your tax benefit. Using a $100,000 asset with a $50,000 cost basis, donating directly can produce an effective tax benefit of roughly 59%, while selling first drops that benefit to about 38%. The […]

DAF vs CRT Deduction Limits Under the Big Beautiful Bill (2026)

2026 DAF Deduction Limits Under Trump’s One Big Beautiful Bill: What High W-2 Earners Need to Know TL;DR: Starting in 2026, Trump’s One Big Beautiful Bill Act adds a 0.5% AGI floor for itemized charitable deductions and limits the value of itemized deductions to 35% for top-bracket taxpayers. Here’s how to plan DAF contributions, bunching, […]

DAF vs CRT: Donor-Advised Fund vs Charitable Remainder Trust

CRT vs DAF (Big Beautiful Bill 2026): High W-2 in High-Tax States TL;DR (Quick Summary) If you’re a high W-2 earner in a high-tax state like California or New York and you hold appreciated assets, this guide compares a donor-advised fund (DAF) versus a charitable remainder trust (CRT) under Big Beautiful Bill 2026 context. In […]

How High W-2 Earners Can Cut Taxes by 50%+ by Donating Appreciated Assets (2026)

How High W-2 Earners Can Cut Taxes by 50%+ by Donating Appreciated Assets (2026 update) TL;DR (Quick Summary) High W-2 earners in high-tax states can often unlock an effective 50%+ tax benefit by donating appreciated assets (like stock or crypto) instead of selling first: you may be able to deduct the fair market value (if […]

Boost Your Credit Score Fast With Authorized User Tradelines

Quick Credit Score Boost: How Authorized User Tradelines Actually Help (Auto Loans, Apartments, First-Time Homebuyers in 2026) Quick navigation What is an authorized user tradeline? How credit scores really work (FICO + bureaus) Who tradelines help the most What tradelines do not do What drives bigger score gains How people use tradelines for loans, rentals, […]

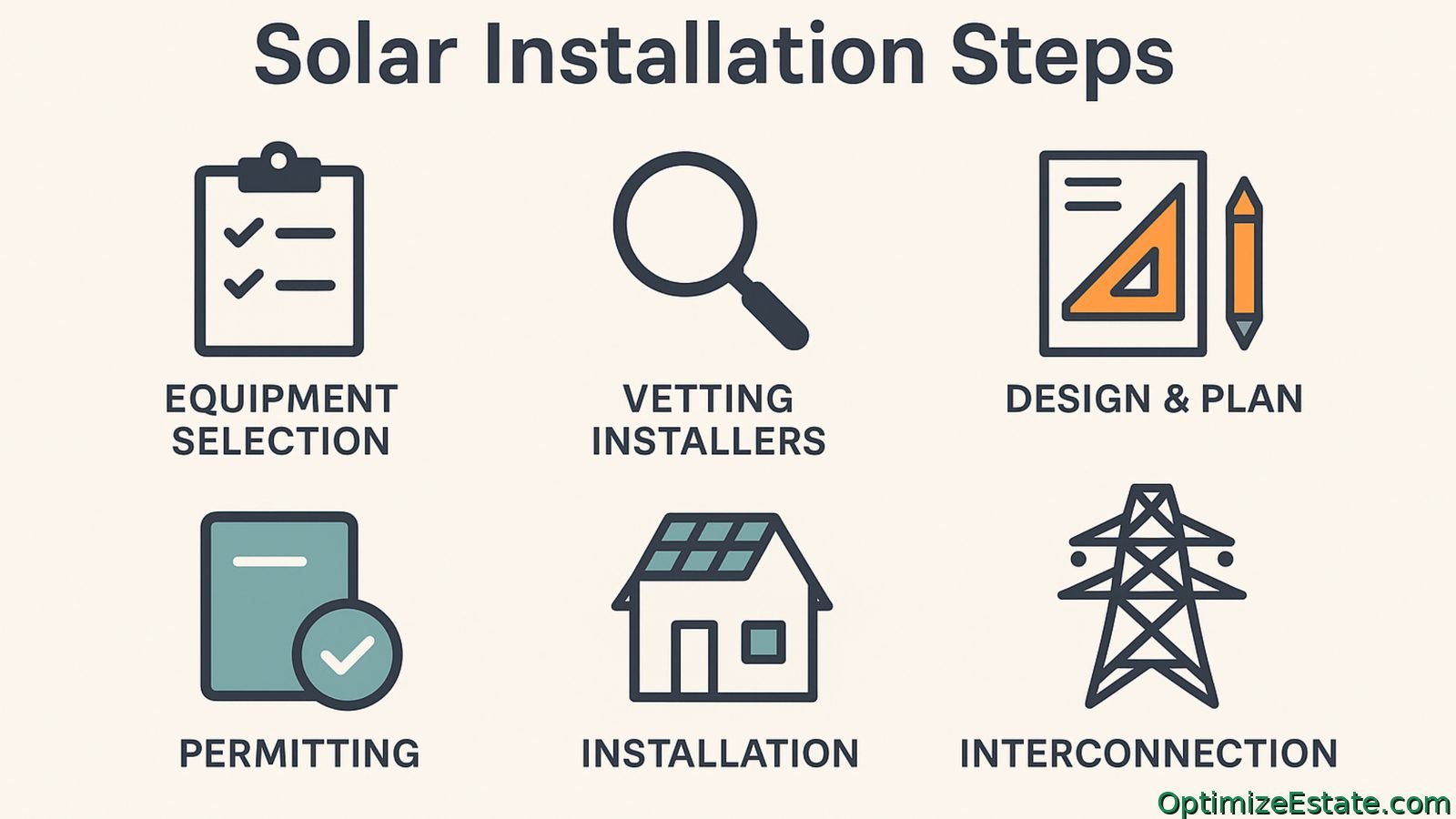

Installing Solar in California: Timeline, Permits, Inverters, and Real Results (2026)

Installing Solar in California: Timeline, Permits, Equipment Choices, and Real-World Results (What I Learned in 2025 That Matters Even More in ) TL;DR: I installed solar in California in 2025, before tax credits ended. What I learned matters even more in . The hardest parts were not installation, but timing, installer selection, permitting, and system […]

Cut Solar Costs 40–60% in 2026: Why Structure Matters More Than Tax Credits

Cut Solar Costs 40–60% in 2026: Why Structure Matters More Than Tax Credits TL;DR: In 2026, solar can still save real money in California—but only when you control total project cost and design around PG&E peak-hour pricing. For many homes, the biggest financial lever is battery strategy that eliminates peak-hour grid usage, not exporting extra […]

- 1

- 2