Authorized User Tradelines vs Credit Repair: When Each Works Better

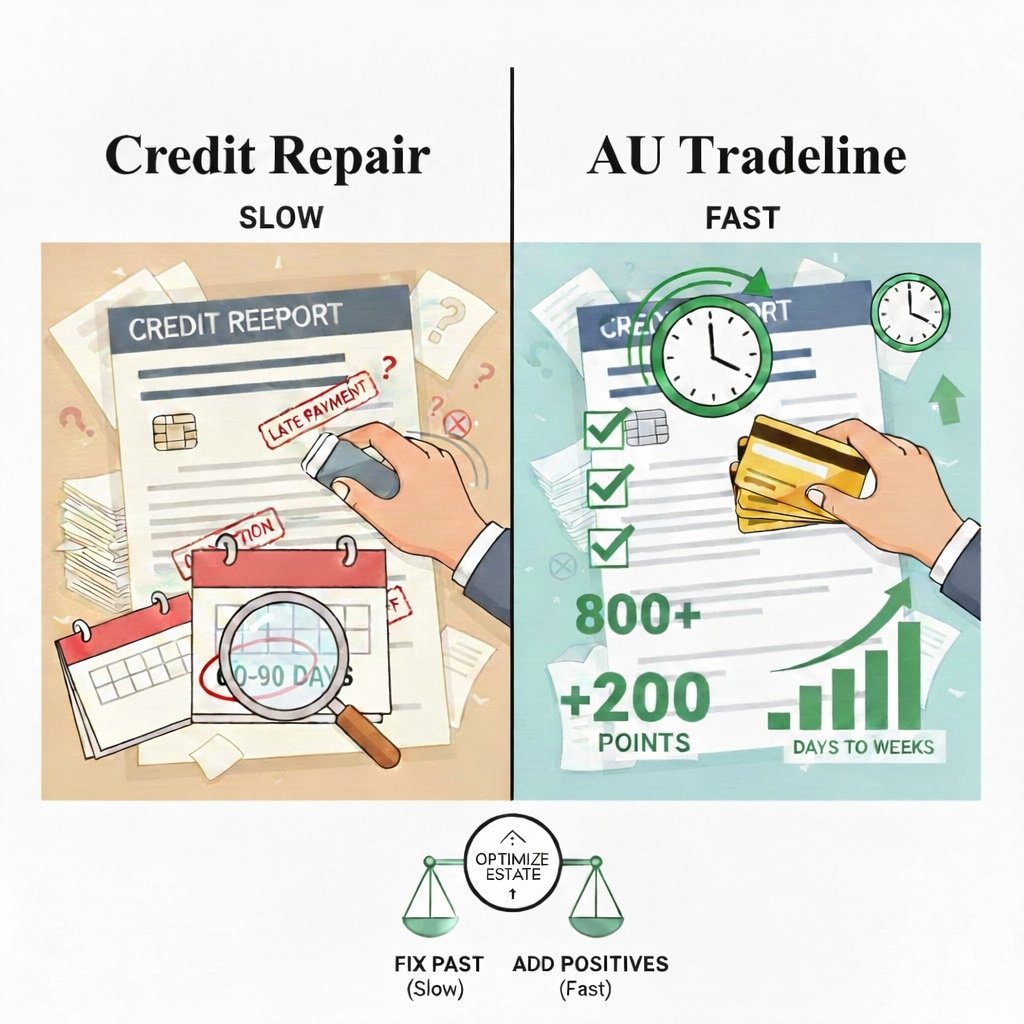

TL;DR: There are two main ways to improve a credit score. Credit repair focuses on fixing past problems by working with creditors and credit bureaus, which often takes months. Authorized user tradelines don’t fix old mistakes, but they add strong positive information to your credit report and can improve scores in days to weeks. Many people use both, depending on timing and credit situation.Two main ways people try to fix their credit

When someone wants to improve their credit score, they usually take one of two approaches.The first approach looks backward. It focuses on fixing or correcting past problems on a credit report. This is commonly called credit repair.

The second approach looks forward. It focuses on adding new positive information to the credit report to improve how the credit profile looks today. Authorized user tradelines fall into this category.

Method 1: Credit repair focuses on past history

Credit repair means reviewing your credit report line by line and addressing negative or incorrect items. This applies whether an account is open or closed.For example, a closed account can still hurt your score if it shows an unpaid balance, a charge-off, or a collection status. These often appear on credit reports as “closed with balance,” “charged off,” or “collection account,” all of which signal unresolved obligations.

In some cases, you can contact the creditor or collection agency and negotiate a partial or full payment. After payment, the account may be updated to show the obligation as satisfied or settled, which can reduce ongoing damage.

If an account is still open and past due, another option is to bring it current and ask the creditor for a goodwill adjustment. Some creditors may agree to remove one or more late payments if you bring the account up to date.

Credit repair also includes disputing incorrect information. If your report shows late payments you never made, balances already paid, or accounts that don’t belong to you, you can file disputes with Experian, Equifax, and TransUnion.

Even when everything goes smoothly, credit repair usually takes 60 to 90 days or longer before score changes appear.

Method 2: Authorized user tradelines add positives

Authorized user tradelines work differently. Instead of fixing old problems, they add new positive information to your credit report.When you are added as an authorized user to a well-managed credit card, that account may appear on your credit report and strengthen your overall profile by adding higher credit limits, lower credit utilization, positive payment history, and older account age.

Tradelines do not remove collections or late payments, but they can offset them by improving how your credit looks today.

Because tradelines usually report within one billing cycle, the timeline is much faster. Many people see movement within days to weeks once the account reports.

For example, if a tradeline’s statement closes on the 6th of each month and you are added on the 4th, the account often reports shortly after, commonly around the 12th to 15th of the month.

When tradelines are especially effective

Authorized user tradelines tend to be most effective for people with thin credit profiles, low credit limits, or high credit utilization.Students or borrowers with limited history can benefit from immediate increases in available credit and account age. People with high balances often see meaningful improvements when added credit limits reduce utilization.

This is why many people with scores in the 500s or 600s see noticeable improvement once the right tradeline reports.

Which option should you choose?

Credit repair and authorized user tradelines are not competitors. They solve different problems.Credit repair fixes the past and takes time. Tradelines strengthen the present and work faster.

Many people use both — working on disputes and negotiations in the background while using tradelines to improve approval chances for time-sensitive needs.

For more detail on how authorized user tradelines work and when they make the most sense, see our main guide:

Authorized User Tradelines Credit Boost (FICO)

For an external reference, the Consumer Financial Protection Bureau explains how disputing credit report errors works and what to expect:

CFPB: How to Dispute an Error on Your Credit Report

Experience and credibility

Execution matters with tradelines. We’ve supported over 500 users for more than two years, helping people add authorized user tradelines that report correctly and follow credit bureau rules. While results vary, many users see score movement within days to weeks once accounts report. We also maintain 100% positive feedback on eBay, reflecting transparency and consistency.Next step

Considering authorized user tradelines?

You can view all available tradelines and current availability here. This page lists the tradelines we offer, reporting expectations, and whether an option is currently open or sold out.