2026 DAF Deduction Limits Under Trump’s One Big Beautiful Bill: What High W-2 Earners Need to Know

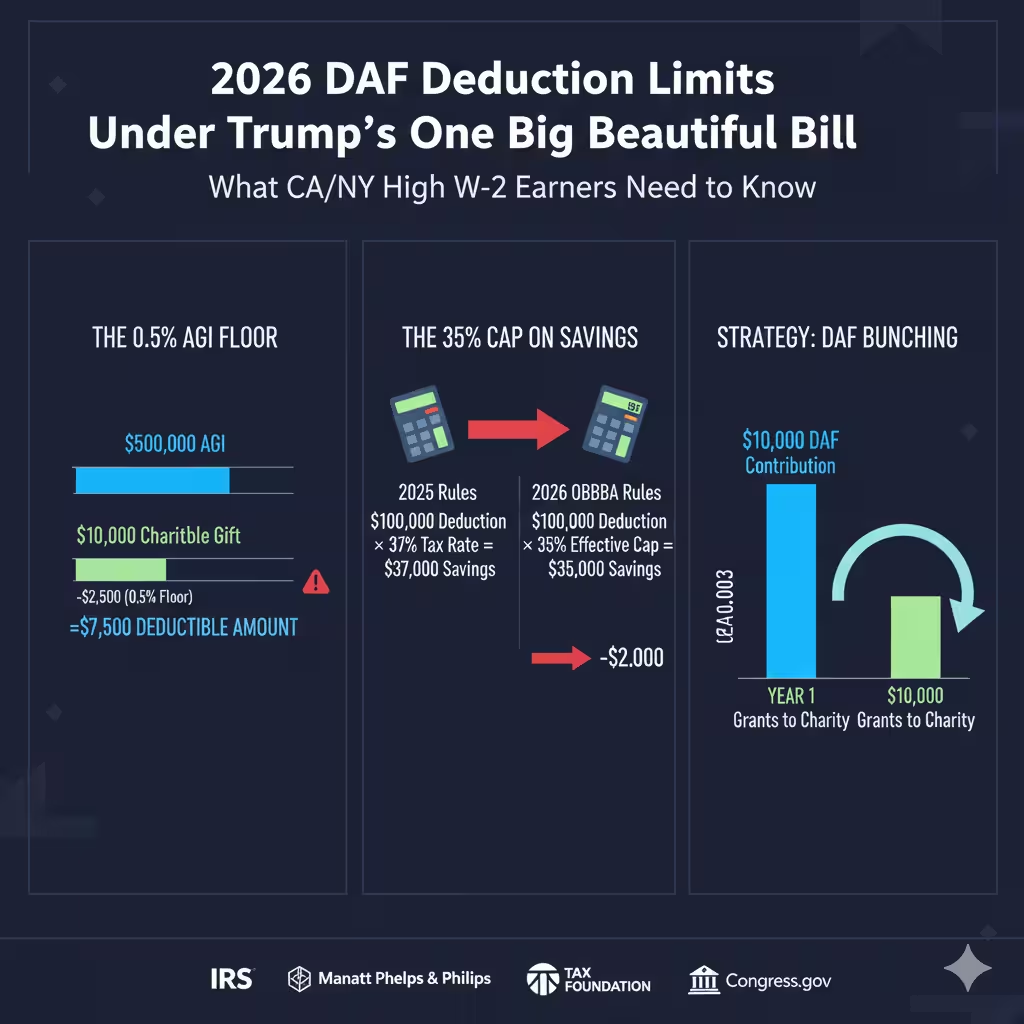

TL;DR: Starting in 2026, Trump’s One Big Beautiful Bill Act adds a 0.5% AGI floor for itemized charitable deductions and limits the value of itemized deductions to 35% for top-bracket taxpayers. Here’s how to plan DAF contributions, bunching, and appreciated-asset giving.

Quick navigation

If you’re a high W-2 earner in California or New York, a donor-advised fund (DAF) is still one of the cleanest ways to reduce federal taxes while supporting causes you care about. What changes in 2026 is the “how much benefit do I actually get?” math around itemized deductions—so the same donation can produce less tax benefit if you don’t plan around the new rules.

A small personal note (brief): I used to treat charitable giving like a simple shortcut—donation × marginal rate. The more I modeled real outcomes in high-tax states, the more I realized the edge comes from deduction mechanics, timing, and asset choice—not just giving more.

These 2026 changes are tied to the One Big Beautiful Bill Act signed into law in 2025 (Public Law 119-21), with multiple provisions affecting deductions beginning in 2026.

What changes in 2026 that matters for DAF planning

Two specific changes under the One Big Beautiful Bill Act are especially important for itemizers:

New 0.5% AGI floor for itemized charitable deductions

Starting in 2026, itemized charitable deductions apply only to the extent your total qualifying charitable gifts exceed 0.5% of your adjusted gross income (AGI).

New limitation on the value of itemized deductions for top-bracket taxpayers

Beginning in 2026, taxpayers above the top-rate threshold face new restrictions on itemized deductions; many summaries describe this as effectively capping the value of itemized deductions at 35% for those in the 37% bracket.

Why this matters: DAFs don’t become “worse” in 2026. But the rules change how much the deduction is worth and how much of your giving actually counts as deductible.

The baseline DAF deduction limits still apply

Separate from the new 2026 floor/cap, the long-standing percentage-of-AGI limits still control how much you can deduct in a given year, depending on what you donate:

This is still the core engine of DAF planning: contribute in a high-income year (take the deduction then), and grant to charities over time.

How the 0.5% AGI floor hits high W-2 earners

The new rule is simple: the first 0.5% of AGI in charitable giving doesn’t count toward your itemized charitable deduction.

Example:

AGI = $500,000

0.5% of AGI = $2,500

If you donate $10,000 total, the deductible portion is $7,500 (assuming other rules are met)

Practical impact for CA/NY high W-2 households:

Planning move that often wins: bunching with a DAF

A DAF lets you contribute in one large “bunch year” (so you clear the 0.5% floor easily), then grant steadily for multiple years. This is especially useful if your W-2 spikes (bonus year, RSU vest year, severance year).

How the 35% limitation changes “savings per dollar”

If you’re in the top bracket, you may be used to thinking “each $1 of deduction saves me 37 cents federally.” Under the One Big Beautiful Bill Act’s new itemized deduction restrictions, many analyses describe an effective cap of 35 cents per dollar for top-bracket taxpayers starting in 2026.

This sounds small, but it compounds on large deduction years. When you’re talking about a six-figure DAF contribution, a couple cents per dollar becomes real money.

The 2026 DAF strategy that matters most

Treat “timing” as the strategy (not the DAF itself)

In 2026, timing matters more because:

What to do:

Put appreciated assets at the center of your plan

For high earners, the biggest incremental win often comes from avoiding capital gains by donating appreciated assets directly (stock/ESPP/crypto) rather than selling and donating cash.

If you want the clearest explanation of why “sell then donate” is often a costly mistake—and how to avoid it—embed your internal link to DAF6 in that section of your site (it pairs perfectly with this post).

Contribution vs grant timing is still the DAF superpower

The deduction happens when you contribute to the DAF (and follow substantiation rules), not when you send grants later. That means you can:

Don’t lose the deduction to paperwork

This is unglamorous but critical in high-dollar giving:

IRS Publication 526 is the practical baseline for substantiation and deduction mechanics.

A quick 2026 decision framework for CA/NY high W-2 earners

Ask these four questions:

Will my giving exceed 0.5% of AGI by a meaningful margin in 2026?

Am I in the top bracket where itemized deductions face new restrictions (often summarized as a 35% cap)?

Do I have appreciated assets I should donate directly instead of selling first? (Link to DAF6.)

Do I want to separate tax timing (contribute now) from charitable timing (grant later)? That’s the DAF advantage.

If you’re also evaluating whether a CRT is still worth it under the 2026 landscape (and when the complexity actually helps), embed your internal link to DAF2 where you talk about “structure choice” so readers can follow the decision tree without leaving your site’s logic.

Ebook at the end

The Flexible Giving: Best DAF & CRT Administrators by Asset Type and Control

This ebook covers the execution layer most articles skip: the DAF and CRT administrators I vetted, what assets they actually accept (including less-standard assets), what investment options they offer, and where flexibility or restrictions show up in real life—so your 2026 plan doesn’t fail because the provider can’t (or won’t) handle your asset mix the way you assumed.

FAQ

In most cases, there is no federal “use it by” deadline that forces you to grant everything within a set number of years, but DAF administrators often have their own minimum grant activity or account balance policies. Practically, you can keep funds invested and recommend grants over time, as long as you follow your administrator’s rules and only recommend grants to IRS-qualified charities.

Yes. Donating appreciated assets is often the highest-impact move because it can avoid capital gains tax that would reduce what reaches charity if you sold first. A DAF can be especially useful when the charity you want to support cannot accept the asset directly, or when you want to separate deduction timing (contribute now) from grant timing (give later).

For larger non-cash gifts, you may need additional substantiation beyond a standard receipt. Depending on the asset type and value, that can include Form 8283 and, for certain assets over certain thresholds, a qualified appraisal by a qualified appraiser. Good documentation is critical because the tax benefit can be reduced or disallowed if substantiation is incomplete.